The Real Estate sector is the most known in India. It has grown by 120 billion U.S. dollars in 2017 and is approximated to reach up to one trillion by 2030, this data is given by tax guru. So the purchase and sales of property and homes are going to increase rapidly. Besides the budget, 2022 was also a capital investment concentrated budget. It indicates that the government is also investing in infrastructural development projects.

The purchase and sale of immovable property are very frequent transactions, so TDS on house property first comes to the mind of sellers/buyers.

What is TDS, and why should you know about it?

TDS is a legal tax deduction scheme that applies in India to the purchase and sale of residential real estate. The buyer is required to deduct a portion of the transaction price and submit it to the government as TDS when buying a property worth more than a specific amount. Additionally, as a buyer, you can compare the cost of living in Mumbai vs Bangalore if you intend to purchase real estate in one of these major cities.

Similarly, when selling a home, the seller may be required to pay TDS. The Income Tax Act specifies the applicable rate for TDS on property transfers as well as the exact processes for deduction and deposit. Noncompliance with TDS regulations may result in penalties.

Who deducts the TDS in real estate transactions?

When buying a property, a buyer has the option to deduct TDS at the rate of 1% if the sale value is 50 lakhs or more. However, starting on April 1, 2022, TDS must be deducted if the sale value or stamp duty value (S.D.V.) of the house or property exceeds fifty lakhs. In India, TDS is additionally accessible when buying or selling property owned by the HUF family.

TDS is to be deducted on all different types of properties, whether it be residential, commercial, or industrial property, except agricultural land because the land measurement is done in Bigha which is a traditional form of measuring the land.

Significance of Budget 2022 in TDS?

Buyers should have to deduct TDS on house property at the rate of 1% even if the sale value of a property is less than the stamp duty value.

Sales Value | Stamp Duty Value(S.D.V) | Significances and Applicable of TDS | |

Case 1 | 60,00,000 | 70,000,00 | Till 31 March 2022 TDS is required to be deducted @1% on 60,000,00. From 1 April 2022, TDS is required to be deducted @1% on 70,000,00. So the difference of 10,000.00 will be taxable in the hands of the buyers |

Case 2 | 70,000,00 | 60,000,00 | TDS should be deducted by @1% on 70,000,00 |

Case 3 | 60,000,00 | 60,000,00 | TDS should be deducted by @1% on 60,000,00 |

Case 4 | 45,000,00 | 55,000,00 | Till 31 March 2022 TDS should not be deducted as the sales value is not more than 50 lakhs. But from 1 April 2022, TDS should be deducted on 55,000,00 and other tax charges will also be applied. |

Case 5 | 45,000,00 | 45,000,00 | TDS should not be deducted as per the rule because the sales value and SDV are less than 50 lakhs. |

How to deposit the TDS deducted amount?

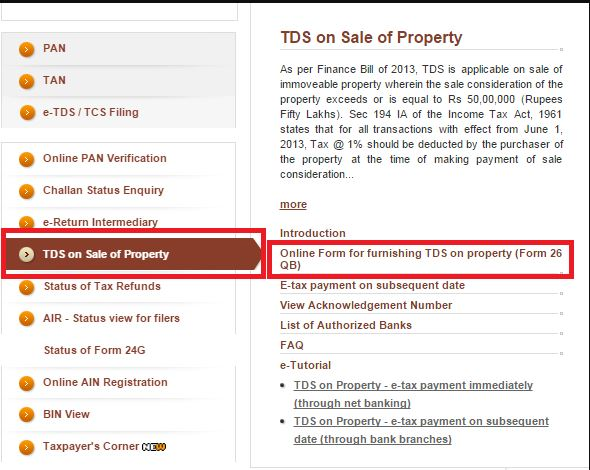

Buyers are not required to take the TAN number. He or She can simply fill out the 26B form which is available on the website- https://www.incometax.gov.in/iec/foportal/ and deposit the TDS amount to the government from the seller.

The TDS amount that has been deducted at the time of the property payment transaction should be deposited to the government within 30 days from the month in which the TDS deduction is made. Buyer should be required to equip the TDS certificate from form 16B to the seller between 10 to 15 days after depositing the TDS deducted amount.

Source: Bemoneyaware

When TDS deduction on the purchase of house property is not required?

- When the sales amount or Stamp Duty Value (S.D.V) of property or home is less than 50 Lacs.

- If a property is considered for agricultural land.

- If the seller is a non-resident of the country then section 195 applies.

Practical issues in TDS deduction?

- TDS should be paid in total amount, but excluding GST amount.

- One cannot apply for the lower deduction of the TDS amount as per the rule.

- In the case of a home loan, the TDS is deducted at the time when payment is made to the seller, not when the bank pays the EMI.

- In the case when there is more than one buyer and the individual purchase amount of each buyer is less than 50 lacs, but the total payment exceeds 50 lacs then the TDS is necessary to be deducted.

- TDS should also be deducted on advance payment.

- No additional or extra charge on TDS.

TDS deduction on purchase of house property

TDS deduction on the purchase of house property is a legal requirement in India. When someone purchases a property that is worth more than a certain amount, they have to take out a certain amount (currently 1%) as TDS from the sale consideration of the property.

Applicability of TDS deduction

TDS on house property is applicable when the property is being bought from a resident seller. It doesn’t apply to property bought from a non-resident seller. By purchasing an 18.6-acre plot of land in Mumba’s Kandivali neighborhood,

In India, there’s a tax (TDS) deducted by the buyer when purchasing a house from a resident seller. This doesn’t apply to non-residents. This might be a consideration if you’re looking at Godrej Codename Big Bull project in Kandivali, offering modern amenities, a luxurious lifestyle, and Vastu-compliant designs.

Rate of TDS deduction

The TDS on house property is 1% of the property’s sale consideration value and as they can change over time, there are also so many property transfer charges in India.

Threshold

If the property’s sale consideration value is less than ₹50 lakhs, no TDS is applicable. This means TDS is only deducted on transactions above this threshold.

The PAN of Seller and Buyer

Both the buyer and seller must have a Permanent Account Number (PAN). The TDS is deducted and deposited with the government using these PANs.

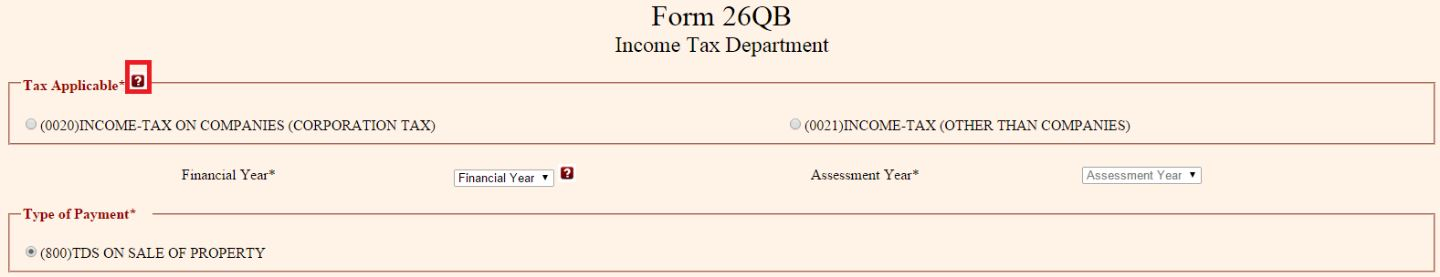

Form 26QB

The buyer is responsible for deducting the TDS and depositing it to the government. This should be done using Form 26QB, which is available on the income tax department’s website.

Source: Bemoneyaware

TDS payment should go to the government

The TDS on house property must be paid to the government within a specific time frame, usually within a week of the end of the month in which the TDS was deducted.

If you want to buy a house but are having trouble finding one that fits your budget, contact a property expert at PropertyCloud.

Documents requirement to pay TDS

Numerous documentation is often required for paying TDS on various transactions, including property acquisitions, to ensure compliance with tax requirements. The particular paperwork may vary depending on the nature of the transaction, but here are some usual criteria for TDS on property acquisitions in India:

Permanent Account Number (PAN)

The buyer and the seller (if x is the buyer) should have a valid PAN. This is a crucial requirement for TDS deductions and payments.

Form 26QB

Form 26QB is the Challan cum Statement for TDS on house property. One needs to fill out this form to make the TDS payment. One can find and fill out this form online on the Income Tax Department’s website.

Necessity sales deed

A copy of the sale deed, which is the legal document that records the sale transaction. It should include details such as the property’s description, sale consideration, and the names of the parties involved.

If the sale agreement is separate

If there is a separate sale agreement in addition to the sale deed, one may need a copy of that as well.

Full information on sale consideration

Information about the total sale consideration value, which is the amount one should agree to pay for the property. This amount should be mentioned in the sale deed.

Details information about the property

Detailed information about the property, including its address, size, and any other relevant details. There are different types of houses in India so one should give all the information about the house or property

Should have buyer and seller details

Details of the buyer (if X is the seller) or seller (if Y is the buyer), including their name, address, and PAN.

Should have payment details

Information about how the payment was made, such as the mode of payment (cheque, bank transfer, etc.) and the transaction date.

Should have bank challan details

If one is paying the TDS through a bank, he will need the bank challan details.

TDS amount calculation

One will need to calculate the TDS on house property amount based on the applicable TDS rate (e.g., 1%) on the sale consideration value.

Date of deduction of TDS

The date on which TDS was deducted. This should be the date of payment or credit, whichever is earlier.

TAN (Tax Deduction and Collection Account Number)

For example, if you are a buyer, you should have a TAN. It’s not required for individual buyers, but it is essential for other entities (like companies) making property transactions.

PAN verification is important

Verify the PAN of the seller through the NSDL or UTITSL websites to ensure its validity.

Benefits of paying TDS to the government

Paying TDS to the government has various advantages for both taxpayers and the government:

A steady revenue stream for the government

TDS ensures a regular and steady flow of tax revenue to the government. Tax is deducted at the source before the income is received by the payee, making it less likely for individuals and entities to evade or delay their tax obligations.

TDS helps in reducing tax evasion

TDS helps in curbing tax evasion by ensuring that tax is deducted at the time of payment. This reduces the possibility of the payee underreporting their income or not disclosing it at all.

TDS helps in terms of convenience for taxpayers

For individual taxpayers, TDS simplifies the tax payment process. Instead of making a lump-sum tax payment at the end of the financial year, the tax is deducted in installments, making it more manageable.

TDS helps to comply with tax laws

Complying with TDS rules helps taxpayers avoid penalties and legal consequences. Non-adherence can result in penalties or interest charges.

TDS helps to reduce tax liability

TDS amounts deducted during the year are considered advance tax payments. These amounts are adjusted against the total tax liability when the taxpayer files their income tax return. This can lead to a reduced tax liability or a potential refund.

TDS provides transparency

TDS provides a transparent record of tax deducted, which is beneficial for both parties involved in a transaction. It ensures accountability and reduces the potential for disputes.

TDS helps in terms of financial discipline

TDS encourages financial discipline among taxpayers by promoting regular tax payments throughout the year, helping them budget for their annual tax liability.

If you are having trouble understanding the loan process and other government fees when purchasing a home, contact a home loan professional at PropertyCloud for the best assistance.

Compliance with legal requirements

TDS compliance is a legal requirement in many transactions and industries. Failing to deduct and deposit TDS can lead to legal repercussions.

TDS encourages a formal economy

By requiring TDS, the government encourages the formal economy and discourages cash transactions, which are often associated with tax evasion.

TDS supports government initiatives

Tax revenue collected through TDS helps fund government initiatives, infrastructure development, and public services, benefiting society as a whole.

TDS necessary to be paid on the property

TDS on house property is required for real estate transactions, If the property is in any city like in tier 1,2,3 and 4 in India one has to pay TDS on the property purchase. The TDS rate on the sale of property is set at 1% of the actual sales consideration under Section 194-IA.

If the buyer fails to deduct the tax or both the buyer and seller fail to submit Form 26QB, they will face several legal repercussions. So avoid that and get your dream home without hassle with the help of PropertyCloud experts. We make sure you get your dream home with all the documentation!

Hello I am Ayushya, i am a passionate content writer with a strong desire to write content that will help readers make better decisions and guide them in the correct direction. An unscalable growth strategy focuses on providing meaningful information about all aspects of real estate as well as for any sector i can write a human written content with 0% AI use.